Overview

Presentation

Fact Sheet

Analyst Coverage

Stock Information

Share Structure

Financials

WHY LITHIUM CHILE

“We have one of the top lithium exploration portfolios in the world’s top lithium jurisdiction. We are well-funded and have active exploration programs underway. Chile is pushing to expand lithium production and Lithium Chile is ideally positioned to provide the projects needed for that expansion.”

– Steve Cochrane, CEO of Lithium Chile

THE RIGHT JURISDICTION

Chile has the world’s largest, high-grade lithium reserves and the lowest-cost production. The country has well-developed infrastructure and is pro-mining.

THE RIGHT PEOPLE

Lithium Chile has a top-tier team with a track record of successful lithium exploration and corporate finance. The team has also has extensive connections in Chile and Argentina.

THE RIGHT ASSETS

Lithium Chile has a premium portfolio, including flagship projects that have high-grade, shallow-depth lithium brines, near-surface. The project also benefits from proximity to developed infrastructure.

Development Projects

Exploration Projects

STOCK QUOTE

Lithium Chile trades on the TSX-V exchange under the symbol “TSX-V:LITH”

Lithium Chile is covered by the following analysts:

Firm:

- Fundamental Research Corp.

Analyst:

- Sid Rajeev

Lithium Chile is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding Lithium Chiles performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of Lithium Chile or its management. Lithium Chile does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations.

About This Asset

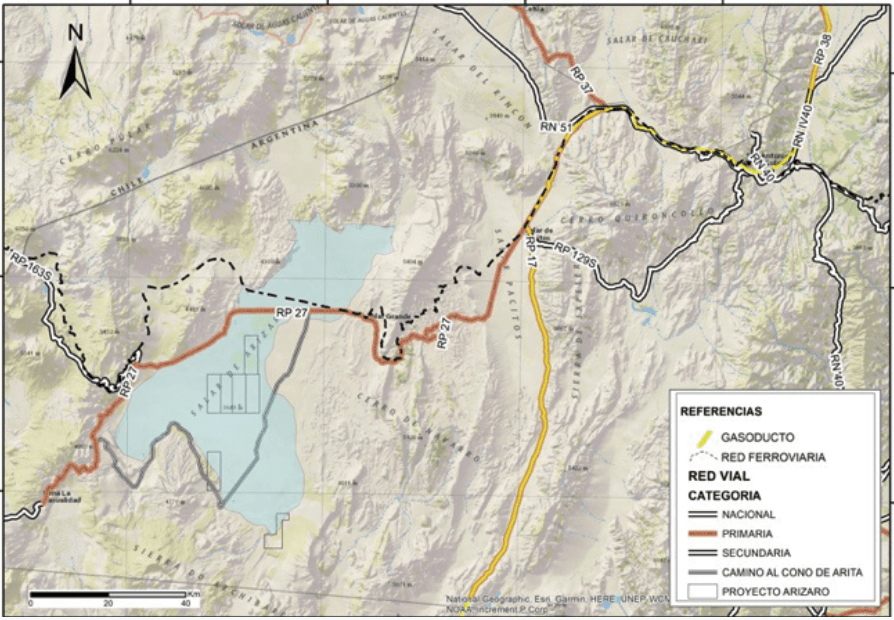

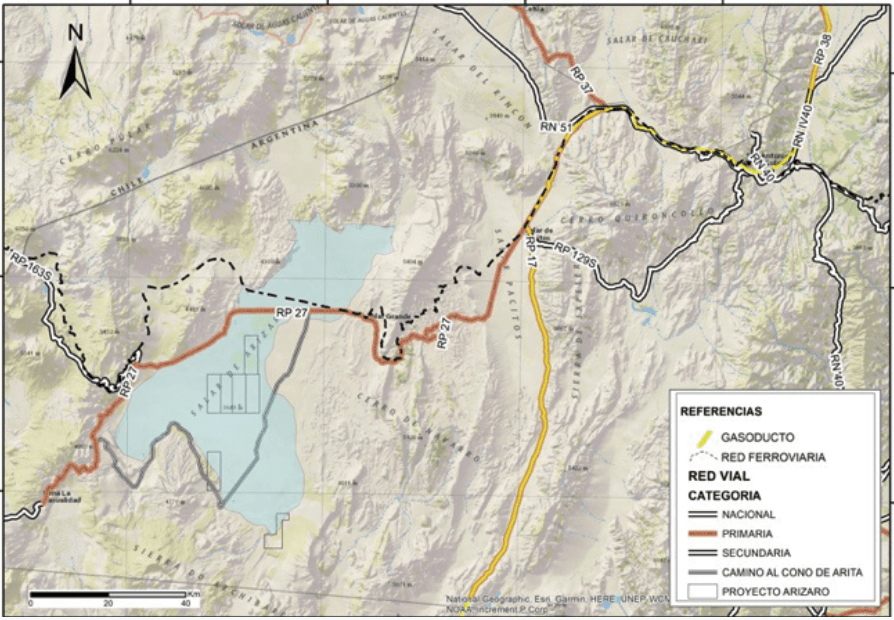

- Water: from south, at Chascha Sur

- One Community, Mining Friendly: Tolar Grande

- Neighbors” Mansfield (Under Construction), Taca-Taca (Exploration)

- Infrastructure: Railroad to Chilean ports; Airstrip (Mansfield); Good potential for Solar PV

| Securities | Amount | Price | Expiry Date |

|---|---|---|---|

| Common Shares, Outstanding | 162,302,627 | ||

| Share purchase warrants | 10,059,999 | $0.85 | Sep. 2023 |

| Share purchase warrants | 6,922,817 | $0.75 | Sep. 2023 |

| Share purchase warrants | 11,877,313 | $0.60 | Sep. 2023 |

| Broker warrants | 566,872 | $0.28 | Aug. 2022 |

| Share purchase options | 5,700,000 | $0.45 – $0.95 | Aug. 22, 2022 – Sep. 17, 2031 |

| Common Shares, Fully Diluted | 197,429,628 |

as of March 31, 2022

About This Asset

- Water: from south, at Chascha Sur

- One Community, Mining Friendly: Tolar Grande

- Neighbors” Mansfield (Under Construction), Taca-Taca (Exploration)

- Infrastructure: Railroad to Chilean ports; Airstrip (Mansfield); Good potential for Solar PV